Rocket mortgage va loan requirements open the doorway for service members, veterans, and their families to achieve homeownership with simplicity and flexibility. Understanding these requirements is the first step to unlocking a host of benefits designed especially for those who have served our country, and Rocket Mortgage streamlines the process for you.

Whether you’re navigating eligibility, credit score expectations, or the property rules for a VA loan, knowing what to expect can make the application process much smoother. From minimum service standards and documentation to credit and occupancy guidelines, Rocket Mortgage provides a trusted pathway for securing your VA loan advantage with confidence.

Overview of VA Loans and Rocket Mortgage

VA loans offer a valuable pathway to homeownership for eligible veterans, active-duty service members, and certain military spouses. Designed to honor military service, these government-backed loans provide significant advantages including no down payment, flexible credit requirements, and competitive interest rates.

Rocket Mortgage, a leading digital mortgage lender, serves as an approved VA lender. The company streamlines the process of applying for a VA loan, combining user-friendly technology with experienced mortgage professionals who guide borrowers from application through closing.

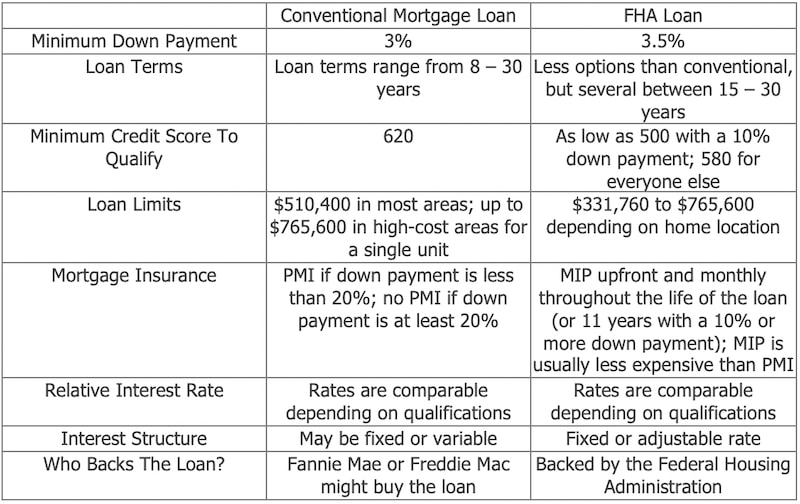

Unlike conventional mortgages, VA loans are backed by the U.S. Department of Veterans Affairs. This backing reduces risk for lenders and enables features like zero down payment, no private mortgage insurance (PMI), and lower closing costs. In contrast, conventional mortgages generally require higher credit scores and down payments, making VA loans a unique and powerful benefit for those who qualify.

Main Differences Between VA Loans and Conventional Mortgages

The main distinctions between VA loans and conventional loans revolve around eligibility, down payment requirements, and government backing. VA loans are designed specifically for individuals with a record of military service, while conventional loans are available to the general public.

- VA loans require no down payment, whereas conventional loans typically require at least 3-5% down.

- No private mortgage insurance is required for a VA loan, while conventional loans usually require PMI if the down payment is less than 20%.

- VA loans have more flexible credit and income requirements, reflecting the VA’s mission to serve veterans and active-duty members.

- Conventional loans have stricter credit score and financial criteria since they are not government-backed.

Eligibility Criteria for a Rocket Mortgage VA Loan

Eligibility for a VA loan with Rocket Mortgage is determined by military service history and specific borrower status. These criteria ensure that the benefit is reserved for those who have served or are serving the nation, as well as some surviving spouses.

To qualify through Rocket Mortgage, applicants must meet the VA’s service requirements, which can differ based on whether the applicant is active-duty, a veteran, member of the National Guard/Reserves, or a surviving spouse. The nature and length of service, discharge status, and certain other factors play a role.

| Requirement | Description | Who Qualifies | Additional Notes |

|---|---|---|---|

| Minimum Service | At least 90 consecutive days active duty during wartime or 181 days during peacetime | Veterans, active-duty service members | Length may vary based on service era |

| 6 Years Service | Completed at least 6 years in the National Guard or Reserves | Guard/Reservists | Must be honorably discharged or still serving |

| Surviving Spouse | Unmarried spouse of a veteran who died in service or from service-connected disability | Surviving spouses | Some remarried spouses may qualify |

| Certificate of Eligibility (COE) | Proof of entitlement to VA loan benefits | All applicants | Obtained through VA or Rocket Mortgage assistance |

Minimum Credit Score and Financial Requirements

Rocket Mortgage evaluates each VA loan application based on creditworthiness and financial stability. While the VA does not impose a minimum credit score, Rocket Mortgage typically looks for a score of at least 580 to 620, though higher scores may be required for certain loan types or better rates.

Applicants will need to verify their income and employment history to demonstrate their ability to repay the loan. Rocket Mortgage requests documentation that reflects steady employment and sufficient income.

- Recent pay stubs – show current earnings and employment status.

- W-2 forms for the previous two years – verify ongoing employment and income.

- Tax returns (sometimes required for self-employed applicants) – demonstrate total income and deductions.

- Bank statements – confirm assets for closing costs and reserves.

- Benefit statements for veterans receiving disability or pension income.

Property and Occupancy Requirements

For a VA loan from Rocket Mortgage, the property itself must qualify under VA guidelines and serve as the borrower’s primary residence. This ensures that the program supports homeownership rather than investment or vacation properties.

Eligible properties include single-family homes, certain condominiums approved by the VA, and some multi-unit properties (up to four units) if the borrower occupies one unit as their primary residence.

| Requirement | Property Type | Occupancy Rule | Notes |

|---|---|---|---|

| Primary Residence | Single-family, VA-approved condo, up to 4-unit property | Borrower must occupy as main home | Investment/rental properties not eligible |

| Occupancy Timeline | All eligible property types | Move in typically within 60 days of closing | Exceptions possible for deployed service members |

| Property Condition | All eligible property types | Must meet VA’s Minimum Property Requirements | Ensures property is safe, sound, sanitary |

Key Takeaways on Property and Occupancy, Rocket mortgage va loan requirements

Meeting property and occupancy rules is essential for VA loan approval with Rocket Mortgage. The home must be safe, structurally sound, and serve as your primary residence for at least the foreseeable future.

Loan Limits and Funding Fees

VA loan limits with Rocket Mortgage generally follow the Federal Housing Finance Agency (FHFA) conforming loan limits, but eligible borrowers with full entitlement typically face no loan limit as of 2024. In high-cost areas, borrowers may be able to finance homes above standard limits with no down payment, provided entitlement is not reduced by prior VA loan use.

All VA loans include a VA funding fee, a one-time charge that helps support the program. The fee amount depends on factors like down payment, borrower type, and whether it’s a first-time or subsequent use. Some individuals, such as those receiving VA disability compensation, may be exempt.

| Type of Borrower | First-Time VA Loan | Subsequent Use | Funding Fee Percentage |

|---|---|---|---|

| Regular Military | 2.15% | 3.3% | Varies by down payment |

| Reserves/National Guard | 2.4% | 3.3% | Lowered with down payment above 5% |

| Disabled Veteran | 0% | 0% | Funding fee typically waived |

Key Funding Fee Insights

Rocket Mortgage helps clarify funding fee calculations and can identify possible exemptions, ensuring borrowers understand upfront and ongoing costs associated with their VA loan.

Required Documentation and Application Steps

Applying for a VA loan through Rocket Mortgage is straightforward when you have the right documents and understand the process. Rocket Mortgage’s digital platform guides applicants step-by-step, but preparation is key to a fast and smooth approval.

Step-by-Step Application Procedure

The process involves several key phases, from initial inquiry to final loan closing. Each step ensures eligibility, verifies financial standing, and confirms the property meets VA requirements.

- Pre-qualification: Submit basic information online to estimate your eligibility and budget.

- Documentation Submission: Upload required personal, financial, and military service documents.

- Credit and Income Review: Rocket Mortgage reviews your credit, income, and employment history.

- Property Selection: Choose a VA-eligible property and sign a purchase agreement.

- Appraisal and Underwriting: The home is appraised, and all documentation is reviewed by Rocket Mortgage’s underwriters.

- Final Approval and Closing: Complete final paperwork, pay closing costs, and receive keys to your new home.

Essential Documents for VA Loan Applications

Proper documentation is critical for a successful VA loan application. These items provide proof of eligibility, income, and financial stability.

- Certificate of Eligibility (COE) – Establishes entitlement to VA loan benefits.

- DD-214 or Statement of Service – Verifies military service and discharge status.

- Pay stubs and W-2s – Supports evidence of steady income and employment.

- Tax returns – Required for self-employed or those with variable incomes.

- Bank statements – Proves assets available for closing costs and reserves.

- Government-issued ID – Confirms identity and legal ability to enter into a mortgage contract.

- Purchase agreement – Shows intent to buy a VA-eligible property.

Purpose and Significance of Each Document

Bringing the right paperwork helps ensure a quick review and avoids delays.

- COE: Confirms your eligibility for the VA program.

- DD-214/Statement of Service: Documents your service and discharge status.

- Pay stubs/W-2s: Verifies income stability and employment history.

- Tax returns: Offers a complete picture of income for complex cases.

- Bank statements: Demonstrates available funds for closing and reserves.

- ID: Ensures you are who you claim to be, a legal requirement for lending.

- Purchase agreement: Indicates a formal contract for a qualifying home purchase.

VA Appraisal and Home Inspection Process

After submitting your application and selecting a property, Rocket Mortgage coordinates the VA-required appraisal. The VA appraisal protects both lender and borrower by ensuring the home’s value and safety.

A VA appraisal is not the same as a home inspection. While both review the property condition, the appraisal is focused on confirming value and meeting the VA’s Minimum Property Requirements. A home inspection, which is optional but highly recommended, provides a deeper assessment of a property’s systems and possible defects.

Imagine you’ve found your dream home and submitted your Rocket Mortgage VA loan application. Within a week of signing the purchase agreement, a VA-approved appraiser visits the property. The appraiser checks both value and safety conditions, then submits a report to Rocket Mortgage. If the home meets all criteria, underwriting proceeds toward final approval; if issues arise, repairs may be requested before the process continues. This timeline typically takes 7–10 days but may vary based on local market conditions and property type.

Closing Costs and Allowable Fees

When closing a VA loan with Rocket Mortgage, certain costs must be settled, but VA regulations limit the types and amounts borrowers can be charged. Some costs are negotiable and may be paid by the seller or lender.

Below is a breakdown of typical closing fees and who generally pays them:

| Fee Type | Who Usually Pays | VA Limits | Typical Amount |

|---|---|---|---|

| Origination Fee | Borrower | 1% of loan amount | Up to 1% of loan |

| Appraisal Fee | Borrower | Set by VA per region | $500–$800 |

| Title Insurance | Negotiable | No VA limit | $800–$1,500 |

| Recording Fees | Borrower or Seller | Reasonable, per local law | $50–$200 |

| VA Funding Fee | Borrower (unless exempt) | Set by VA | 2.15% to 3.3% of loan amount |

| Other Allowable Fees | Borrower/Seller | Limited by VA | Varies |

Structure of Allowable Fees at Rocket Mortgage

Rocket Mortgage adheres to VA limits, working with buyers and sellers to structure closing costs transparently. Some fees can be negotiated as seller concessions, offering flexibility for buyers and helping minimize cash needed at closing.

Benefits and Limitations of Choosing Rocket Mortgage for a VA Loan

Rocket Mortgage is known for its digital-first experience and dedicated VA loan experts. For many borrowers, this means a fast, convenient process with clear communications and helpful resources. However, there are both pros and cons when considering Rocket Mortgage compared to other VA lenders.

- Pros:

- Streamlined digital platform for fast applications and document uploads

- Dedicated VA loan specialists familiar with military borrowers’ needs

- Transparent fee structures and robust customer support

- Competitive VA loan rates and quick pre-approvals

- Cons:

- Not all property types or loan programs are available in every state

- Highly digital process may not suit those who prefer in-person service

- Some fees may be higher than smaller, local lenders

Tips for a Successful VA Loan Approval with Rocket Mortgage: Rocket Mortgage Va Loan Requirements

Being prepared is key to a smooth VA loan experience with Rocket Mortgage. Following proven best practices ensures that your application is processed efficiently and increases your likelihood of approval.

- Request your Certificate of Eligibility early to avoid delays.

- Check your credit report ahead of time and dispute any errors.

- Gather all required financial documents before starting your application.

- Maintain steady employment and avoid major financial changes before closing.

- Work with a real estate agent experienced in VA transactions.

- Communicate regularly with your Rocket Mortgage representative.

- Schedule a home inspection in addition to the VA appraisal for peace of mind.

- Budget for closing costs and understand what can be negotiated with the seller.

Closing Summary

Exploring rocket mortgage va loan requirements reveals just how accessible home financing can be for eligible veterans and service members. With clarity on the process, documentation, and key benefits, you can approach your dream home with confidence, knowing Rocket Mortgage and the VA loan program are working together to support your next big move.

Q&A

Do I need a down payment with a Rocket Mortgage VA loan?

No, most VA loans through Rocket Mortgage do not require a down payment, making homeownership more accessible for eligible borrowers.

Can I use a Rocket Mortgage VA loan for an investment property?

No, VA loans are only for primary residences, not for investment or vacation properties.

Are there prepayment penalties for paying off a Rocket Mortgage VA loan early?

No, VA loans through Rocket Mortgage have no prepayment penalties, so you can pay off your loan at any time without extra fees.

What if my credit score is below the recommended minimum?

If your credit score is below Rocket Mortgage’s minimum, you may need to improve your score or provide additional documentation to qualify, but it’s always worth discussing your options with a loan specialist.

Can I refinance an existing mortgage with a Rocket Mortgage VA loan?

Yes, Rocket Mortgage offers VA loan refinancing options, including Interest Rate Reduction Refinance Loans (IRRRL) and cash-out refinancing, if you meet the eligibility requirements.